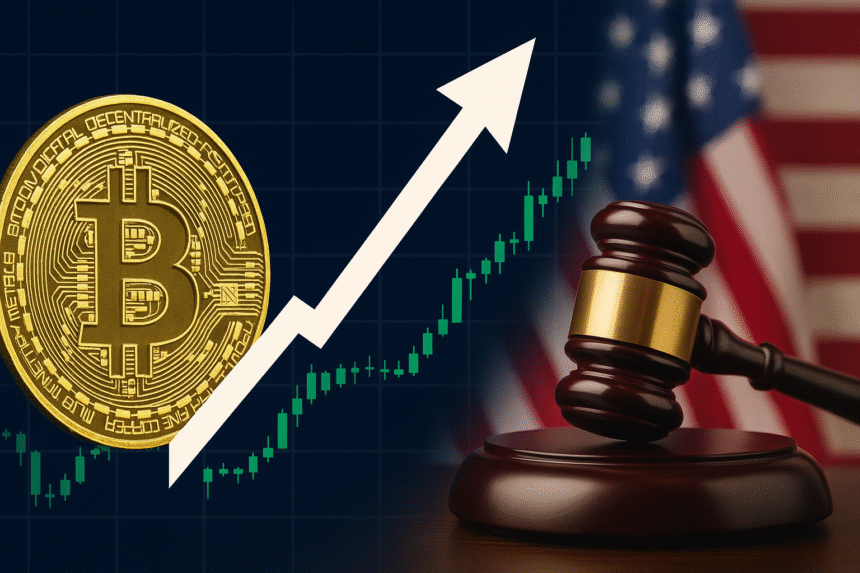

The crypto industry just crossed a historic $4 trillion in market cap—backed by the first U.S. law to regulate stablecoins. Here’s what this breakthrough means for young investors, professionals, and the future of digital money.

On July 18, 2025, something remarkable happened. The total global cryptocurrency market crossed $4 trillion in value. Just a few years ago, many dismissed crypto as speculative hype. Now it’s staking its place beside the biggest asset classes in the world.

But this wasn’t just a market story. It happened in lockstep with something much bigger: the GENIUS Act, a landmark U.S. law that brings real rules and accountability to stablecoins—the digital assets designed to stay pegged to the U.S. dollar.

If you’re in your 20s or 30s and thinking about where to place your bets—in careers, investments, or innovation—this moment deserves your attention.

Let’s break it down.

A $4 Trillion Market Is No Joke

Crossing $4 trillion wasn’t just about Bitcoin skyrocketing again. Sure, the original crypto hit an all-time high of $123,205 earlier that same week. But what really made the difference was the broader participation across the ecosystem.

Ethereum rose 22% in five days. Solana and Uniswap jumped too—by 6.5% and 24%, respectively. These aren’t fringe projects anymore. They’re infrastructure for everything from decentralized finance (DeFi) to NFTs to gaming.

And traditional money is finally stepping in. U.S.-listed crypto ETFs—those exchange-traded funds that let everyday investors buy into crypto without handling wallets or keys—saw inflows like never before. In July alone, $5.5 billion poured into Bitcoin funds. Ether ETFs followed close behind with $2.9 billion.

Big-name firms like Bernstein are calling for a $200,000 Bitcoin by year-end. That might sound ambitious, but the more important story is this: crypto is maturing into a credible, regulated, mainstream asset class.

Enter the GENIUS Act: Crypto’s Regulatory Wake-Up Call

The Guiding and Establishing National Innovation for U.S. Stablecoins Act, better known as the GENIUS Act, is the first real piece of federal crypto legislation in the U.S. Its main focus? Stablecoins.

If you’re unfamiliar, stablecoins are cryptocurrencies tied to stable assets—usually the U.S. dollar—to keep their value steady. They’re the digital cash of the blockchain world, used for payments, transfers, and trading.

The GENIUS Act, passed by a bipartisan House vote and signed by President Donald Trump, creates a legal framework for how stablecoins can be issued, regulated, and monitored.

Key takeaways from the law:

- One-to-one reserves: Every dollar-backed stablecoin must be matched with actual dollars or low-risk assets.

- Regulatory oversight: Issuers must report to either federal or state authorities.

- Anti-money laundering: Measures are now mandatory, not optional.

The bill also makes space for both banks and non-bank companies to issue these tokens—as long as they play by the rules.

For the first time, crypto isn’t in a legal gray zone in the U.S. At least for stablecoins, there’s a clear regulatory map.

Why This Matters for Everyone

This is more than a legal win—it’s a cultural shift. Until now, crypto in the U.S. was growing despite confusion from regulators. One agency treated a coin like a commodity; another called it a security. Some projects just operated offshore to avoid the mess.

Now there’s a blueprint.

This matters for entrepreneurs—because they can now build on-chain tools and payment systems without fearing that regulators will move the goalposts overnight.

It matters for investors—because institutional money usually waits on the sidelines until the rules are clear.

It matters for developers and engineers—because companies will need talent that understands both blockchain infrastructure and the new compliance standards.

And yes, it matters for consumers, too. More stable and regulated crypto means it’s safer to send money abroad, buy digital goods, or hedge against inflation using these tools.

Wall Street and Silicon Valley Are Taking Note

You don’t need to read tea leaves to see where things are going. The market responded almost instantly to the GENIUS Act.

Stocks of companies like Coinbase and Robinhood jumped to all-time highs on July 18. Coinbase, the largest U.S.-based crypto exchange, rose 1% that day. Robinhood, which recently expanded its crypto services, climbed 3%.

Meanwhile, startups in the stablecoin and Web3 infrastructure space are reportedly seeing a surge in venture funding interest again. After a brutal crypto winter in 2022–2023, confidence is returning—and with guardrails.

The Bigger Picture: Could Stablecoins Replace Traditional Banking?

Here’s where things get even more interesting.

Some analysts believe that the stablecoin market—currently at around $265 billion—could grow into the multi-trillion dollar range by 2030.

That’s not just hot air. If stablecoins become a faster, cheaper way to settle transactions, they could start competing with traditional banks for cross-border payments, remittances, and even paycheck delivery.

But the GENIUS Act also comes with guardrails. One of the related bills explicitly bans the creation of a U.S. central bank digital currency (CBDC)—a move that reflects privacy concerns and political divides about federal control of money.

The U.S. is taking a private-sector-first approach. That’s a big signal to companies, developers, and future leaders: if you want to innovate with digital money, now is your time.

What Young Professionals Should Watch Next

If you’re early in your career, here’s what to track in the months ahead:

- Stablecoin adoption in real-world payments: Will companies start paying salaries in USDC or other regulated tokens?

- ETF momentum: Watch how the new Bitcoin and Ether ETFs perform—especially if more funds get approved in Europe and Asia.

- Crypto compliance jobs: As rules get clearer, the demand for legal, risk, and compliance experts with crypto knowledge is already rising.

- Senate debates: The GENIUS Act passed the House. The broader digital asset framework is heading for the Senate next. If passed, it would shape how every coin—not just stablecoins—is regulated.

And for those thinking longer term: crypto is no longer a fringe career path. Developers, analysts, legal pros, product designers, economists—they’re all needed to shape what comes next.

One Law, One Market Move, Many Possibilities

The GENIUS Act’s passage and the $4 trillion milestone aren’t just numbers or headlines. They mark a turning point.

For years, crypto was about rebellion. Now, it’s about building something lasting—with rules, safeguards, and real economic stakes.

If you’re watching from the sidelines, ask yourself: is this the moment to dive deeper? Whether that means a course, a side project, or a new job path, the window for early leadership in crypto is still open—but it’s getting narrower.

So, what’s your move?